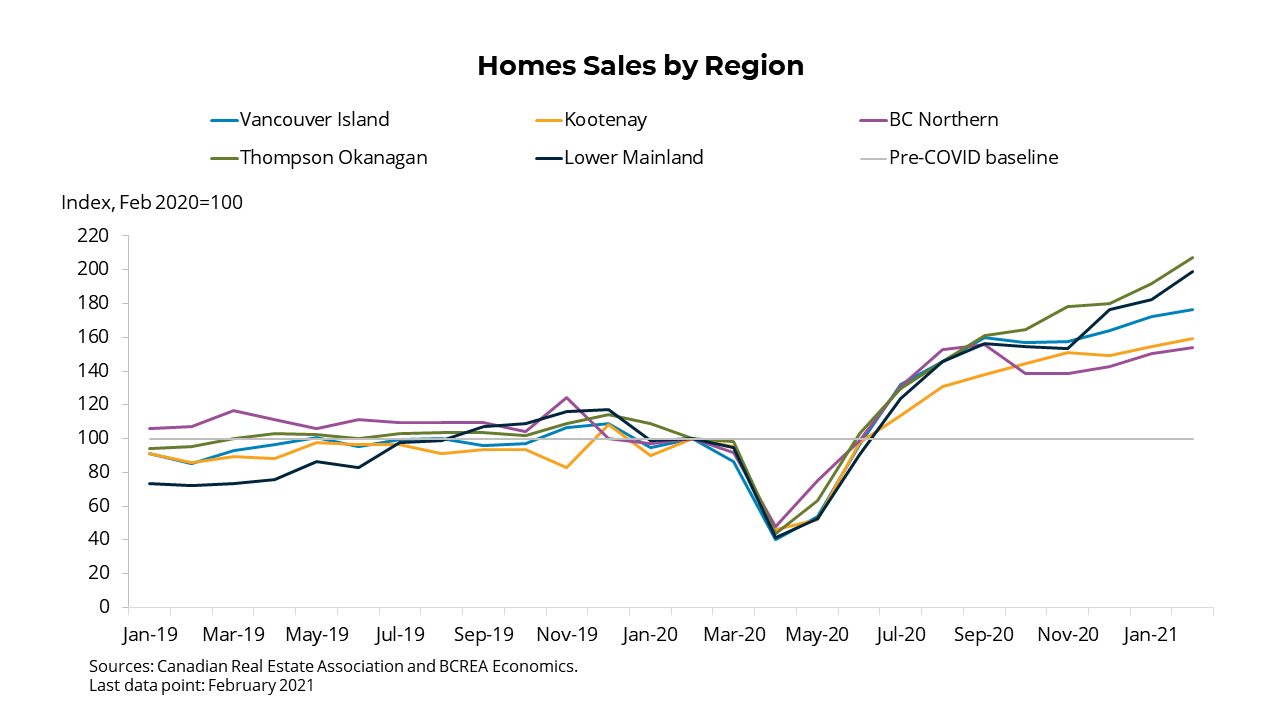

The Victoria Real Estate market kept right on trend with the recent era of the covid housing rush, but with a little injection of the spring market. Speaking of “this era” of covid, we are just now heading into the one full year stretch since the beginning of covid, the beginning era having a very different effect on the housing market than our current one. Remember the whole reason for the beginning of this boom was “pent up demand”, well now we are headed into the one year mark from when that demand was being pent up. The outcome of this is that our year-over-year comparisons are going to start to become less meaningful. While March to March is the start of the weird numbers, April 2020 is when there were really low lows.

March 2021 saw 1,173 total