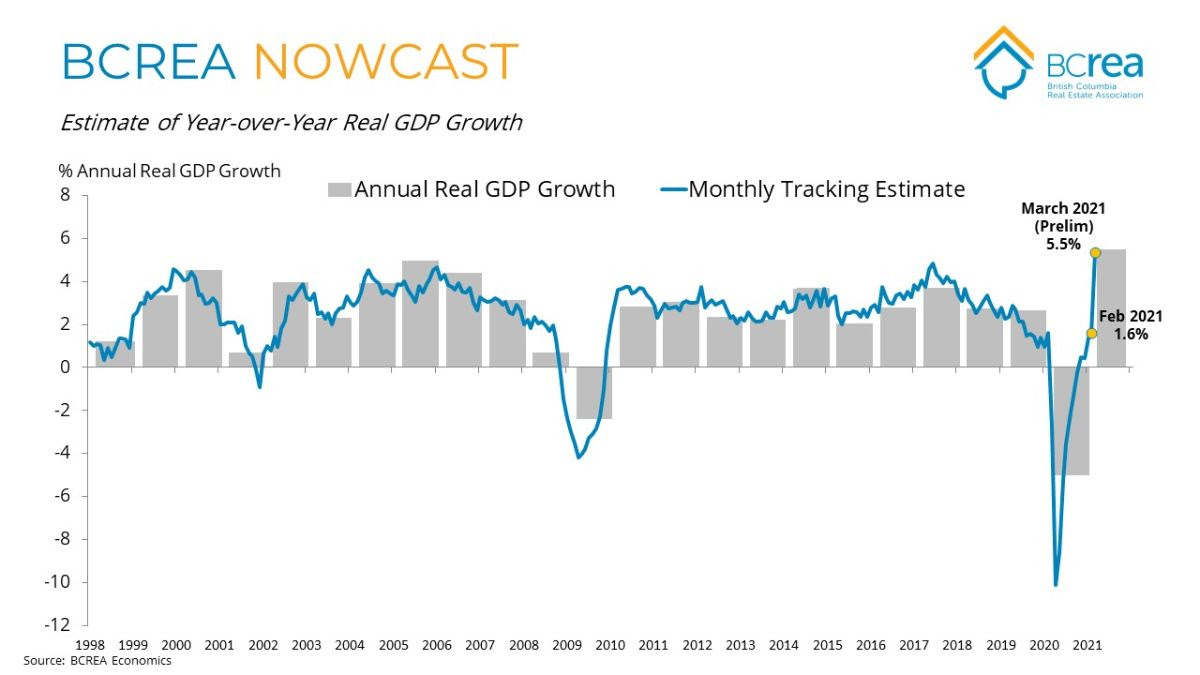

BC Monthly Real GDP Estimate for February 2021 & Preliminary Estimate for March 2021 (Updated: April 30, 2021)

The BCREA Nowcast estimate of provincial economic growth (expressed as year-over-year growth in real GDP) for February 2021 is 1.6 per cent. We have also included a preliminary estimate for March 2021 of 5.5 per cent. Starting in April, we expect to see very large growth due to base-year effects as strong incoming 2021 data is compared to the lowest point of 2020 during the initial stages of the COVID-19 pandemic. For that reason, we have also added a measure of the monthly level of GDP to our NowCast which provides a better indication of how the economy is progressing in its recovery.

Download the full report (PDF)

For

…