There is a new arrival at the office of Ron Neal and The Neal Estate Team at RE/MAX Alliance Victoria … meet Dolly! Dolly is fifteen pounds of Brindle French bulldog and she is very happy to meet you. In fact, she’s become an integral part of our RE/MAX Alliance family and her owner, Jamie, explains the difference she makes in a work day:

There is a new arrival at the office of Ron Neal and The Neal Estate Team at RE/MAX Alliance Victoria … meet Dolly! Dolly is fifteen pounds of Brindle French bulldog and she is very happy to meet you. In fact, she’s become an integral part of our RE/MAX Alliance family and her owner, Jamie, explains the difference she makes in a work day:

“She spends her days in our office at RE/MAX Alliance bringing smiles to faces, she turns moments of frustration into deep breaths with the wiggle of her bum when she sneaks into people’s office unexpectedly for a quick back scratch. From time to time she unexpectedly greets our clients and to their surprise they find themselves smiling too.”

This positive effect jives with several studies that demonstrate the

…

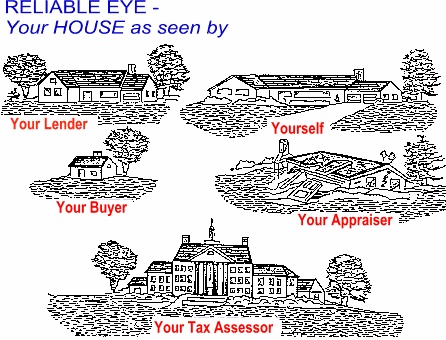

BC Property Value Assessment notices went out last week to owners of the approximately 360,000 households on Vancouver Island. Most notices reflect changes of between -5% and +10% for property values on the island from July 2014 to July 2015. Despite the overall robust market, some property values declined in the period. The cumulative value of property on Vancouver Island raised from $164 Billion to $170 Billion and more than $2 Billion of that increase was from new construction, subdivisions and rezoning.

BC Property Value Assessment notices went out last week to owners of the approximately 360,000 households on Vancouver Island. Most notices reflect changes of between -5% and +10% for property values on the island from July 2014 to July 2015. Despite the overall robust market, some property values declined in the period. The cumulative value of property on Vancouver Island raised from $164 Billion to $170 Billion and more than $2 Billion of that increase was from new construction, subdivisions and rezoning.

If you are concerned that your new BCAA property assessment does not accurately reflect your property’s value, you

If you are concerned that your new BCAA property assessment does not accurately reflect your property’s value, you