Purchasing a home is a detailed process involving multiple parties. Everyone is looking to protect their own interest, and there are multiple regulations in place to protect those involved. As one gets involved in the process, they will likely be exposed to real estate terminology like escrow, contingencies and title insurance. Borrowers will likely have to learn about loan to value and loan to income ratios, prepayment penalties and points.

Purchasing a home is a detailed process involving multiple parties. Everyone is looking to protect their own interest, and there are multiple regulations in place to protect those involved. As one gets involved in the process, they will likely be exposed to real estate terminology like escrow, contingencies and title insurance. Borrowers will likely have to learn about loan to value and loan to income ratios, prepayment penalties and points.

One aspect of acquiring a home mortgage that can affect your payments for years is lender's mortgage insurance. What is lender's mortgage insurance, who does it protect, is it necessary and can borrowers impact what it costs? Here's a quick guide to lender's mortgage insurance.

For informational purposes

…

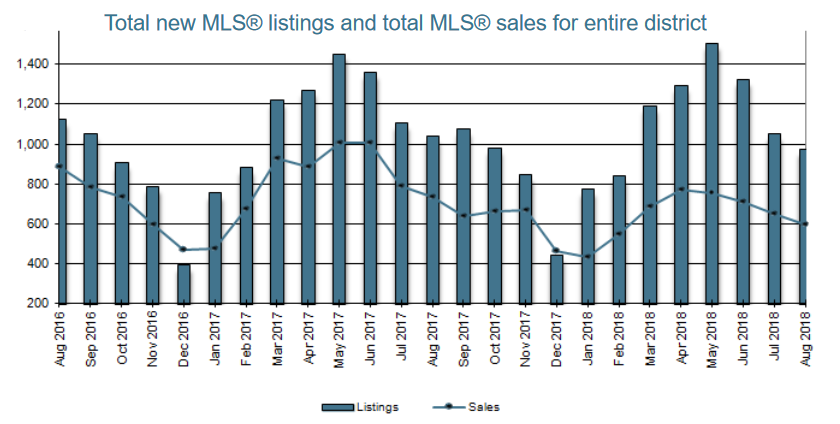

The trend to a balanced market continued through August with a further decline in sales to just 594 properties sold in the Victoria Real Estate Board in August, a decrease of 8.8% from the 651 sold in July and 19.3% fewer than the 736 sold in August of 2017.

The trend to a balanced market continued through August with a further decline in sales to just 594 properties sold in the Victoria Real Estate Board in August, a decrease of 8.8% from the 651 sold in July and 19.3% fewer than the 736 sold in August of 2017.

Owning a Westshore home comes with a lot of joy, but also a lot of responsibility. One of the most responsible things a homeowner can do is protect their investment, and a home warranty is part of the way to do that. These warranties cover some of the issues and items that home insurance policies typically do not protect against, which can help a homeowner reduce their financial burden when something goes wrong. While these kinds of warranties will not cover everything that could be a problem for a homeowner, they are still good ways to have a higher level of peace of mind when owning a home.

Owning a Westshore home comes with a lot of joy, but also a lot of responsibility. One of the most responsible things a homeowner can do is protect their investment, and a home warranty is part of the way to do that. These warranties cover some of the issues and items that home insurance policies typically do not protect against, which can help a homeowner reduce their financial burden when something goes wrong. While these kinds of warranties will not cover everything that could be a problem for a homeowner, they are still good ways to have a higher level of peace of mind when owning a home.

Some Canadians dream of owning a vacation home or buying a vacation condo. They can be used as a consistent location for family gatherings or to get away from the stresses of the world. Buying a vacation home may be easier than first imagined, when current homeowners understand eligibility requirements and general expectations. How easy is it to qualify for a home mortgage loan for a vacation home in Canada?

Some Canadians dream of owning a vacation home or buying a vacation condo. They can be used as a consistent location for family gatherings or to get away from the stresses of the world. Buying a vacation home may be easier than first imagined, when current homeowners understand eligibility requirements and general expectations. How easy is it to qualify for a home mortgage loan for a vacation home in Canada?