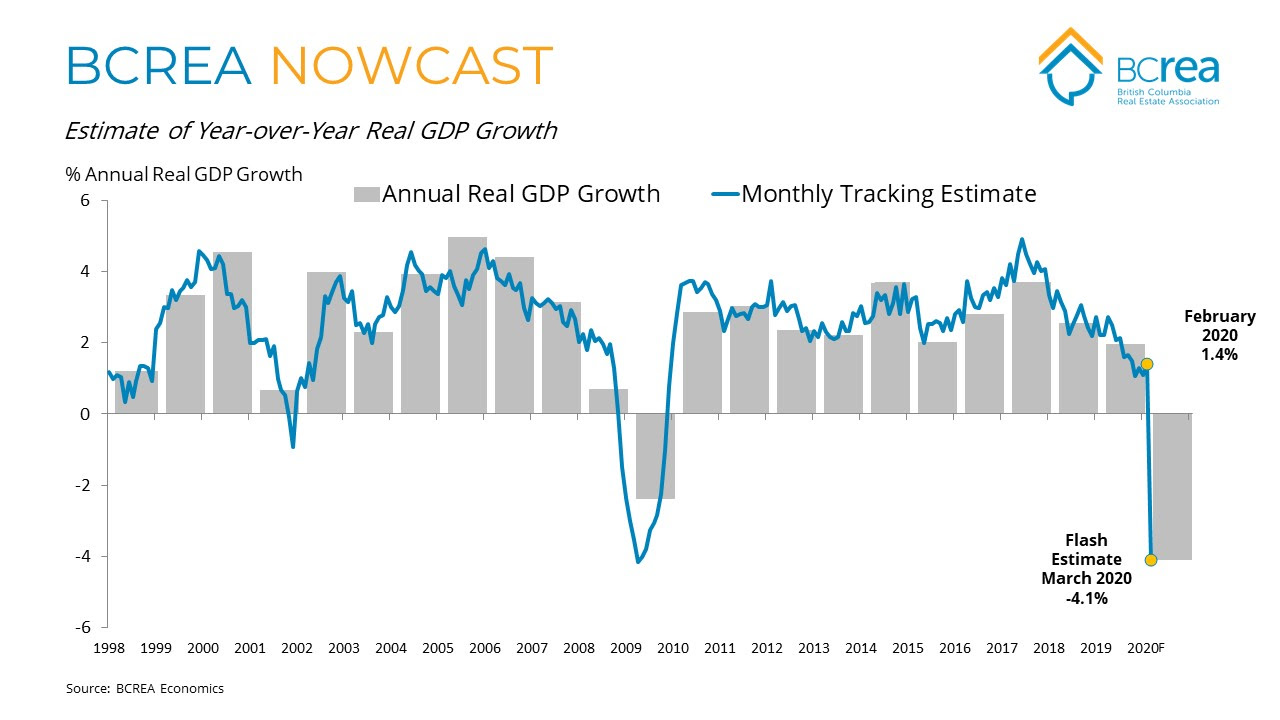

BC Monthly Real GDP Estimate for February 2020 & Flash Estimate for March 2020 (Updated: April 30, 2020)

The BCREA Nowcast estimate of provincial economic growth (expressed as year-over-year growth in real GDP) for February 2020 is 1.4 percent, up from 1.1 percent annual growth in January. We have also included a flash estimate of growth for March 2020 of -4.1 percent reflecting the impact of the COVID-19 pandemic. That estimate will change as the full March dataset becomes available.

Download the full report (PDF)

For more information, please contact:

| Brendon Ogmundson Chief Economist Direct: 604.742.2796 Mobile: 604.505.6793 Email: bogmundson@bcrea.bc.ca |

BCREA is the professional association for more than

…