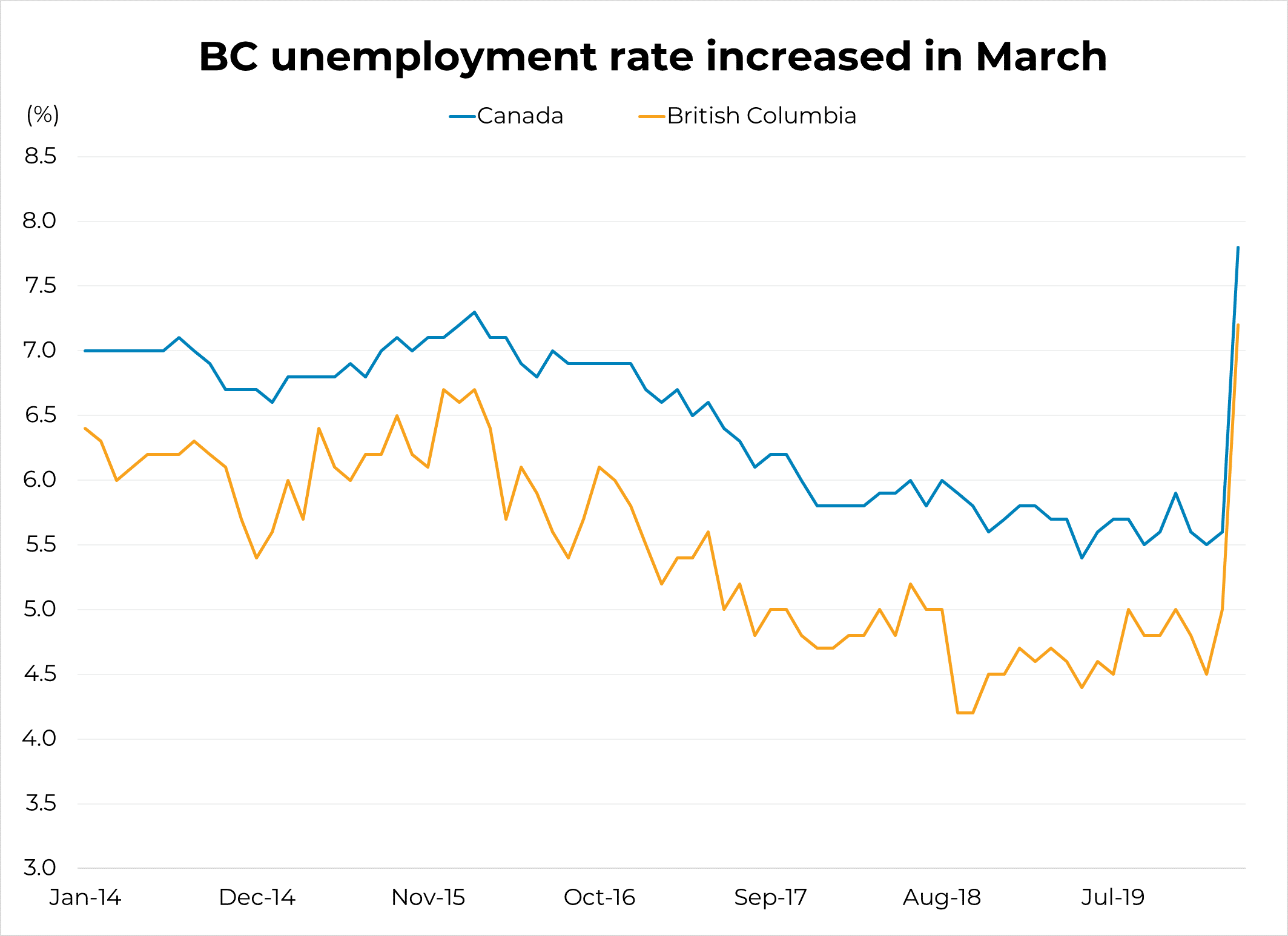

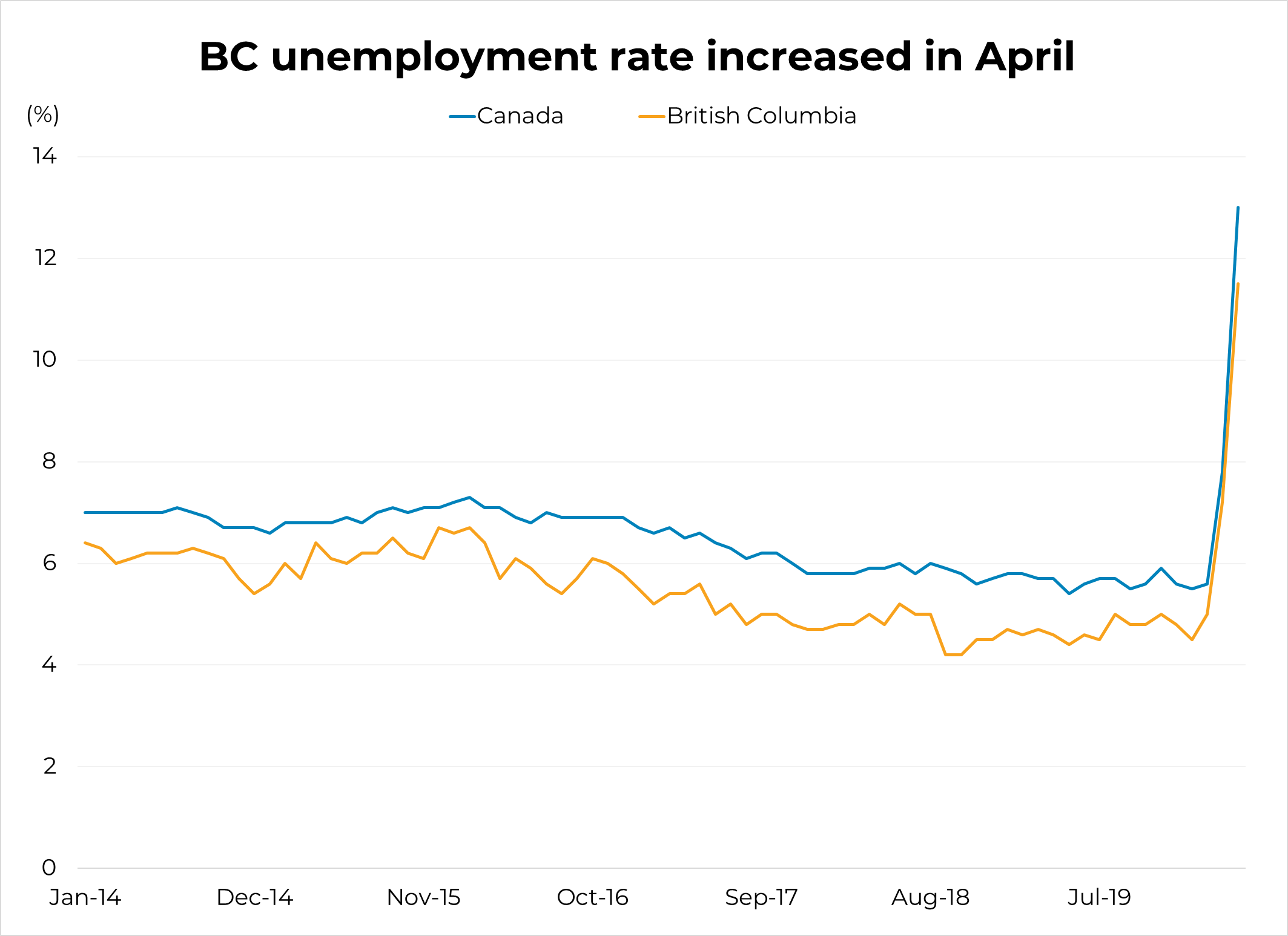

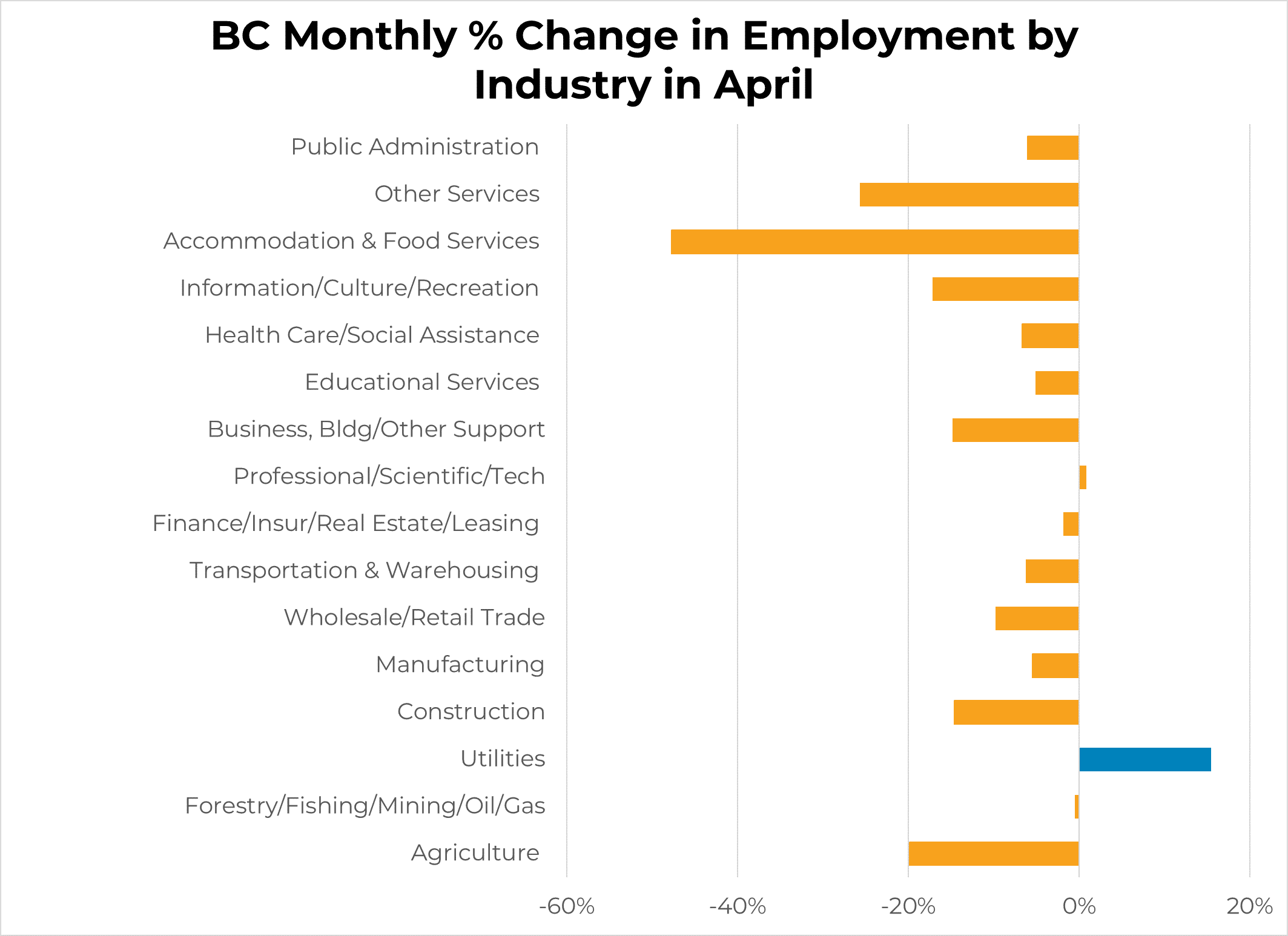

Canadian employment fell further in April by 2 million jobs (-11%, m/m), bringing cumulative losses to 3 million since February. The unemployment rate rose by 5.3 percentage points from 7.8% to 13%, as the impact from the closure of non-essential businesses and travel restrictions were not fully reflected in last month's job report. The last recession to come close to this was 1981/82 when the peak unemployment rate was 13.1%. The unemployment rate would have been 17.8% in April if adjusted to include those wanting to work (and had worked recently), but were unable to because of the pandemic.

Job losses continued to spread across the country, with the largest declines in Ontario (-690k), Quebec (-560k), BC (-264k) and Alberta (-240k). The