Canadian Housing Starts (Aug) - September 9, 2020

Canadian housing starts increased by 7% m/m to 262,396 units in August at a seasonally adjusted annual rate (SAAR). This represents the fourth consecutive monthly increase and the fastest pace of national homebuilding since 2007, pushing up the six-month average to 213,144 units SAAR. August's increase was driven primarily by the multi-units segment in Ontario, marking the province's strongest pace of homebuilding since 1990.

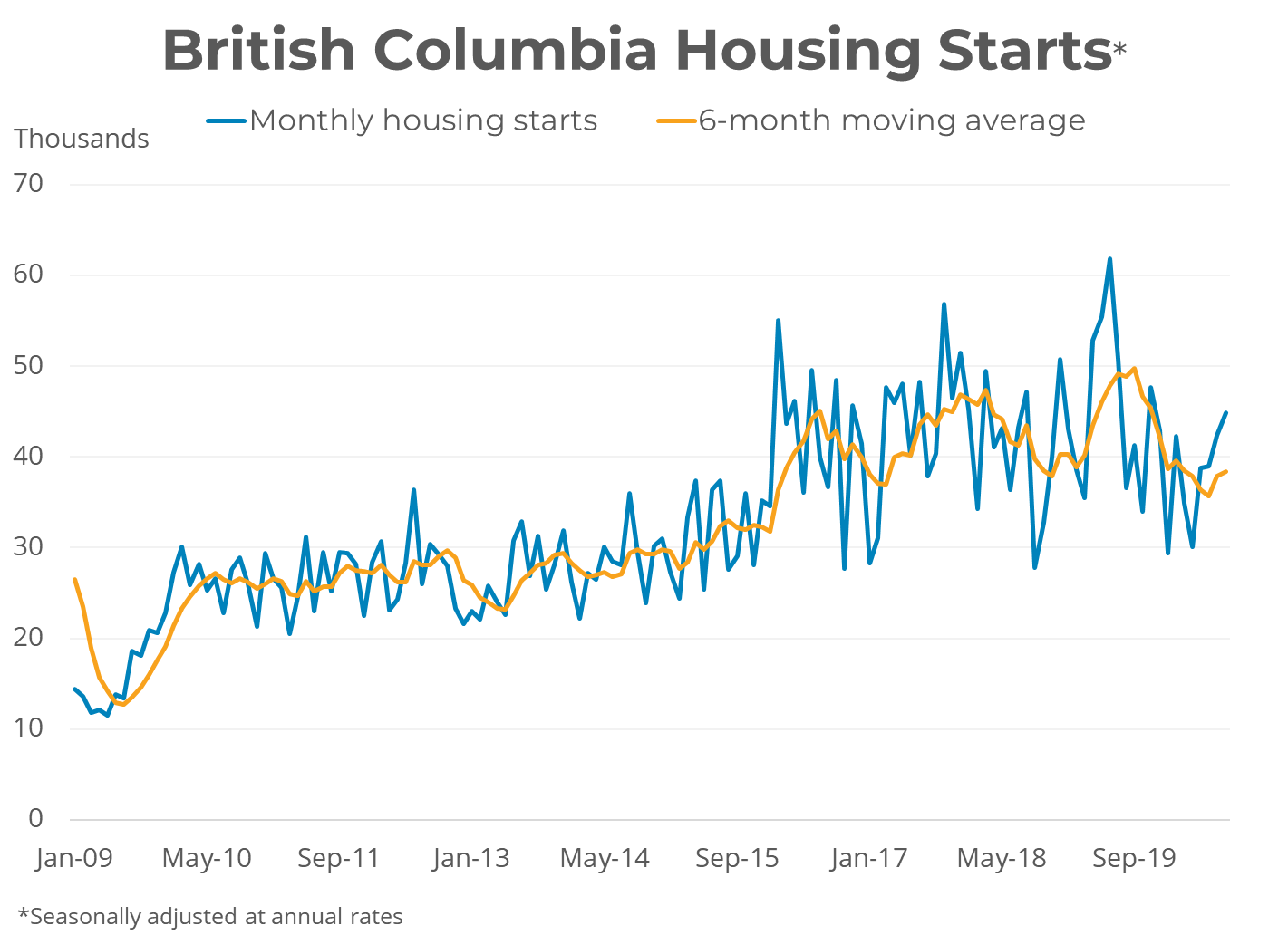

In BC, housing starts increased by 6% m/m to 44,883 units SAAR in August, following an increase of 42,883 in July. The increase was primarily driven by the multi-unit segment. Housing starts in August were above the pre-COVID level. In the near term, we can expect