Victoria Real Estate Market Update by The Neal Estate Group [April 2024]

Posted by Ron Neal on Tuesday, April 25th, 2023 at 8:55am.

At the end of 2023, we predicted “close to 7,000 transactions” in 2024 in the Victoria Real Estate Board area. Re-evaluating now at the close of the first quarter of 2024 its looking like we came in about 7% under that projection. Basically, the first few months are not going gangbusters, although Q1 was about 6% above 2023. That being said, the game could change as soon as June 5th, with the next Bank of Canada announcement widely thought to be the possible first rate drop after 6 consecutive holds.

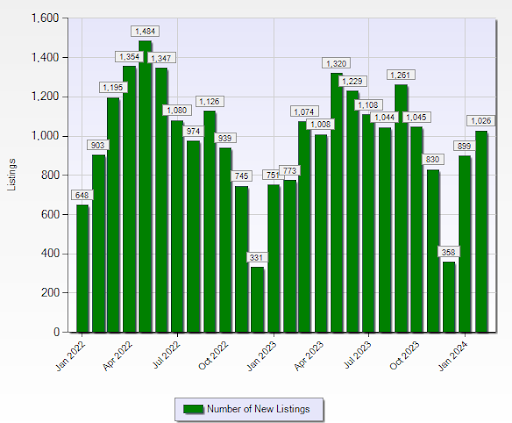

As of April 15th, well into what we would regularly call “The Spring Market”, sales are still a bit sluggish at 18.8 per day compared to 21.2 per day for the month of April in 2023. On the other hand new listings are coming at a smoking clip, with 54.9 new listings per day compared to 34.5 per day last year. It’s worth noting that last April was a bit slow for new listings and this is also a popular time for relists, which will skew these numbers. Regardless, overall inventory and months of inventory are both up, both of which we will get into in more depth.

Getting into the Numbers

Looking at March 2024, sales were down 0.3% in the Victoria board area, with 588 sales (up 25.1% from February). 286 of those sales were single family homes, up 1.8% from last year, and 177 were condo sales, down 10.2% from last year. Single-family homes are still selling relatively quick when priced well and the average days on the market in March for homes in the core was only 30 days.

Looking at inventory, there were 2,647 active listings at the end of March (already 2,896 as of April 15th), up 34.4% from the end of March 2023 and 12% up from the end of February 2024. The increase in inventory is certainly good news for buyers.

Considering Price

While inventory is consistently climbing, demand and the spring market are keeping enough pressure for very minor upward pressure on prices. In March we were at 4.5 Months of Inventory (active listings divided by sales) which would put us close to the seller market side of a balanced market, which feels about right. Looking at price through the MLS system, the average sale price for single family homes in the core have been creeping up month over month since January. Meanwhile condos are also trending up but are a little more volatile.

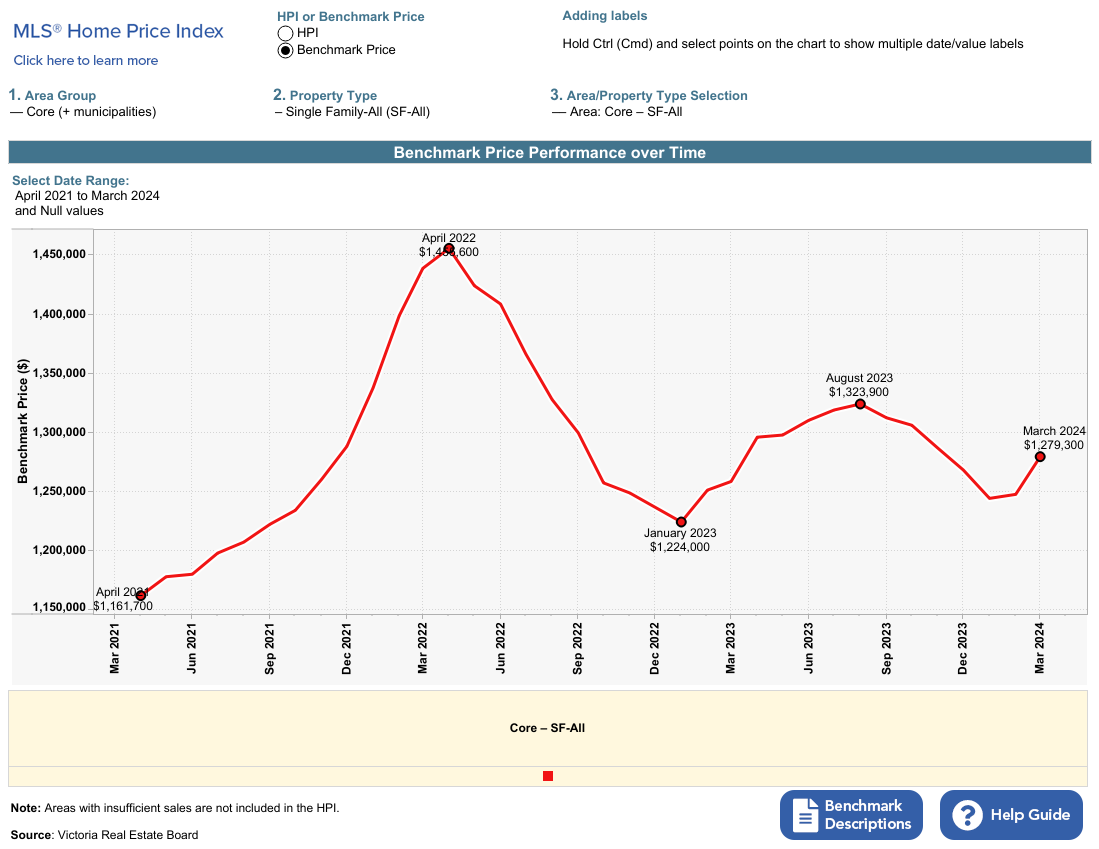

Looking at Benchmark Prices from the Home Price Index here are some key points:

-Single Family Home Benchmark Price was $1,279,300 in March 2024

-Up 4.5% from January’s low

-Down 13.8% from April 2022’s high

-Condos in the core came in at $567,300 (up 3.3% from last year).

Here is a graph to visualize that:

Looking Forward

The crystal ball is a little hazier than normal as we have the great eye of both federal and provincial politics turning sharply towards housing. Both bodies are heading into election mode and are set on introducing policies that could swing things sharply. As for mortgage rates, fixed rates in Canada just dropped sharply with the expectation of an announced drop from the Bank of Canada. Barring policy disruptions, we can likely expect a small bump in activity and more pressure on prices if rates do drop in June, but nothing like the red-hot markets we saw at the peak.

Neal Estate Group Highlights

March was a busy month for The Neal Estate Group in the community. Not only did we hold our 25th annual Easter Egg Hunt - which was attended by about 500 kids who hunted for over 600 pounds of chocolate - but Ron also organized a RE/MAX Head Shave Fundraiser for Children's Miracle Network. Between the two events over $80,000 was raised for Children’s Miracle Network and BC Children's Hospital. As always, a huge thanks to our clients who allow us to do what we do in our business and in our community.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [March 2024]

New listings came in strong for both February and March (to date), while sales stayed (and are staying) much closer to last year's levels. This inventory build-up gives buyers more options, especially in higher-end properties and areas outside the core. A little past the midpoint of March new listings are coming on at a 20% faster clip while sales are about 14% slower so far.

February was much closer in sales volume but told the same story regarding new listings hitting the market. While slower or stagnant sales and increased new listings might indicate a less competitive market, we are instead seeing different parts of the market moving quickly while others sit with longer days on the market.

Getting into the Numbers

In February, there were 470 sales in the VREB area which was 2.2% up from last year (and there was an extra day in the month), and 37.8% up from January which is normal for heading into the spring market. By property type, there were 224 single-family home sales (1.8% up YoY), and 152 condo sales (5.6% down YoY).

As for listings, there were 2,364 active listings at the end of February, 10.5% more than the end of January and 30.7% up from last year. New listing count is another thing to watch closely and is different from the total listing count. As of March 18th, we have 784 new listings and 299 sales, 43.5 new listings a day compared to 36 per day last March.

Here’s a little bit of a longer-term (and seasonal) look at new listing count on VREB:

Considering Price

Prices in the core stayed pretty horizontal compared to last month after a few months of downward movement (since August 2023’s second peak which we showed in last month's update). Single-family home prices decreased 0.3%, a whole $3,600 from the previous year to hit $1,247,400 in February, while at the same time up about the same percentage from January 2024. Condos came in with a benchmark value of $549,300, up 1.4% from last year and down 1.76% down from January.

Looking Forward

At the beginning of the year, we had predicted between 6,800 and 7,000 transactions in the Victoria Real Estate Board area this year. As we grow close to the end of the first quarter of the year things are looking much closer, at least for pending firm deals, to last year than to the projections. If March continues at the sales per day we will end the quarter less than 2% over last year as opposed to the 13% that many were predicting. We are heading into what is normally the busiest few months of the year so we will have a much clearer picture by summer.

Anecdotally, for our agents who have boots on the ground and are seeing things before they are reported as statistics, we had a strong January and February and a slow start to March. Over the Saint Patrick's weekend, things seem to have picked up with lots of accepted offers that might not be reported on the system yet.

Neal Estate Highlights

A big highlight for us at The Neal Estate Group is that we participated in 1 of every 30 transactions in February as our agents stayed busy and helped our clients win in a market that is a bit slower than anticipated. We are also busy preparing for our 25th annual Easter Egg Hunt for BC Children's Hospital happening March 30th this year. With 35,000 chocolate eggs to hide for kids in our community, we can’t wait!

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [February 2024]

So far in February sales are a bit slower than this time last year and new listings are coming on at a faster clip. On the whole, year-to-date sales are up, with January showing strong numbers even if only in comparison to a weak start last year. February could still finish strong as we move closer to what is expected to be a busy spring market.

If we keep on the current pace for February (based on sales per day and listings per day so far in the month) we will hit around 372 sales and 966 new listings. We can expect sales to end up a bit higher than that and new listings probably a bit lower, but ballpark it will put us at the beginning of March with Months of Inventory (MOI) right around 6 months. This is usually an indicator of a pretty balanced market which makes sense for what we are feeling boots on the ground and in the office.

Getting into the Numbers

Looking back to the first month of the year, January 2024 had 341 homes sold in the Victoria region which is 22.7% more than the same month in 2023 (and also 3.6% more than December). Single-family home sales led the charge with a 35% increase and 162 sales, while condo sales rose a more modest 10.9% with 112 transactions.

The end of January saw 2,140 current listings (we are at 2,186 as of Feb 12th) which was a 0.4% increase from the end of December and 23.1% up from a year ago.

Considering Price

The Home Price Index (HPI) had the benchmark (meaning the typical property for the category) price for a single-family home in the core priced at $1,244,000 in January, down from December and up slightly from a year ago. To get a really good idea of how prices for single-family homes in the core have changed in the last few years, here are some peak and trough dates:

April 2022 - $1,455,600

January 2023 - $1,224,000

August 2023 - $1,323,900

January 2024 - $1,244,000

In a visual format, it looks like this:

That puts us right around October 2021 prices. Looking at the median sold prices on the Multiple Listing Service instead of the HPI we get a similar story with the peak in April and the low in December-January with the second peak in September and then a slow decline until now. We can expect this trend to turn around coming into the spring market, but not dramatically.

Turning back to HPI for a second, the benchmark price for a condo came in at $559,000, down slightly from last year and December.

Looking Forward

In the near term, we are heading into what is shaping up to be a classic spring market. This increased seasonal activity will take a small chunk out of inventory as demand outpaces supply for a few months and puts some pressure back on prices. That being said, we have a higher inventory than we had last year and the years proceeding last year so some of the pressure should be taken off.

Longer term we are still somewhat beholden to the Bank of Canada, their rate decisions, and the affordability question that follows it. We are still expecting rate cuts towards the end of 2024 and a hot 2025 spring market as consumers become more optimistic.

Neal Estate Highlights

This month the office is buzzing as everyone gets ready for the busy season in Real Estate. We’ve implemented a few new tools over the last few months in our effort to be constantly improving and it's showing in our client success. With 20 firm transactions already this year and a 2.8% market share of the VREB area our agents are greatly outperforming the average VREB agent and this experience helps our clients win. On that note, we are currently looking to fill a sales partner seat on our team so we would like to ask all our fantastic clients and readers: if you know a great Realtor or someone who would be a great Realtor and hit for our team, please make a connection!

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [January 2024]

2023 was a tough market for Real Estate. Primarily dominated by interest rates, a phenomenon that we haven’t seen in recent years. The demand side was throttled by affordability and the seller side was put under pressure as mortgage rates increased dramatically (for those on a variable or renewing). Some predictions called for a strong buyers' market as sellers got into desperate straights and forced prices down.

And yet that's not exactly what happened. Prices remained surprisingly resilient, dropping from their peak but staying very close to their year-over-year values. Inventory was so low that there was a built-in cushion for the blow on the demand side. The blow was significant though with a sales volume that was a trickle compared to the torrent of 2021, or even the more moderate 2022.

Our inventory grew in 2023 and we went from a strong sellers market closer and closer to balanced conditions finally ending with a slow December.

As of January 15th, new listings are outpacing last year so far and firm deals are lagging behind a bit. It’s likely sales will pick up by the end of the month and lots of new listings will continue to come on as both buyers and sellers generally return to activity after the holidays.

Getting into the Numbers

In 2023 there was a total of 6,207 sales through the Victoria Real Estate Board Multiple Listing System. Predictions for the coming year are generally around the 7,000 mark which is just above 2022 with 6,804 (8.7% higher than last year). Even if we can get to 7,000 sales in 2024 we will be well short of red-hot 2021 which broke 10,000.

In December 2023, 329 properties were sold, 2.8% more than the same month the previous year and 16.5% less than in November. There were 158 single-family home sales (1.3% up year over year) and 108 condo sales (14.9% up).

As for listings, there were 2,132 properties on the market at the end of 2023, which is a 19.4% increase from the 1,688 listings at the end of 2022. This is great news for moving us towards a balanced market with more options for buyers. Many sellers pulled their homes off the market in December which showed as a decrease in inventory from November to December but this was seasonal and we have already seen inventory start to build back up in January.

Considering Price

Looking at Benchmark Prices according to the Home Price Index single-family homes in the Victoria Core rose 2.5% to reach $1,236,500. This is after peaking in April 2022 and then another smaller bump in August 2023 before coming back down to similar year-over-year prices. Condos according to the HPI come in at $562,000, down slightly (0.7%) in the year.

The prediction on price is general stability most of the year and modest gains as interest rates come down towards the end of the year. This is a tentative prediction as there are lots of factors that could change the supply and demand situation quickly, including interest rates coming down faster, a weaker-than-expected economy or policy change.

Looking Forward

With the even stronger than usual caveat that we do not possess a crystal ball, and to summarize our predictions for 2024:

-A continuing trend toward a balanced market

-Modest interest rate drops in 2024

-Close to 7,000 transactions by year-end

-Modest price fluctuations but overall minor increases

Neal Estate Highlights

Thank you to all of our clients who came out to Skate with Santa and helped raise two big full boxes of non-perishables for the Mustard Seed. The event was a ton of fun and we look forward to putting it on next year. Of course, we will see you first at our 24th Annual Easter Egg Hunt (yes, it’s already time for us to start planning that event). On the business front, the new year is always a time for us to take a deep look at our processes and systems. January for us is the month of vision boards and spreadsheets, building on and tweaking our already proven systems to get the absolute best value for our clients.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [December 2023]

As of December 18th sales are continuing at a decent clip, at least for what is typically a slow month. In the next few weeks, as everyone starts moving into holiday mode we can expect both sales and new listings to slow down until the new year.

Heading into the new year there seems to be some optimism within the Real Estate Market as the Bank of Canada (BoC) held rates again in their December 6th announcement. Economists are also predicting decreases forthcoming as soon as April 2024 and for those decreases to continue throughout the year.

In November inventory tightened slightly, very likely due to sellers pulling their home from the Multiple Listing System (MLS) for the holidays. Sales volume also started to drop in line with what is considered seasonal norms. Average sale prices according to MLS are also down marginally for the 3rd month running yet still higher than last year.

Getting into the Numbers

As of December 18th, we are averaging about 11.7 sales per day which outpaces 10.3 sales per day in December last year, but we can expect that average to drop in the coming weeks as things slow down for the holidays. New listings will too. Currently, they are outpacing sales with 16.2 new listings per day compared to 11.6 last year.

Looking back at November, a total of 394 properties changed hands in the VREB region which was a 2.6% increase from November last year and a 3.2% decrease from the proceeding month of October. Single-family home sales stayed relatively steady at 193 sales with a 6% increase year over year while condos with 120 sales decreased 11.8% year-over-year.

As for inventory, there were 2,644 listings available at the end of the month (311 more than there are currently as of December 18th). From October it was a 4.1% decrease but a whole 25.2% increase from the end of November last year.

Considering Price

Looking at price we will note that in November our Months Of Inventory (MOI, active listings divided by sales in the month) came in at 6.7. This level of MOI would typically put us towards the buyer's end of a balanced market which would mean there are lots of options for buyers and not too much pressure on price. This is accurate for the climate as prices have stayed relatively stable over the last few months. Coming into spring we will have to watch the sales to new listings ratio to see if we can maintain that balanced market or if too many buyers will tip the scales back the other way and put more pressure on price.

The Home Price Index (HPI) had single-family homes in the Victoria Core at $1,286,400 at the end of October, a 3% increase from last year but down from $1,305,900 for the same house in November. Condos came in at $577,400, up 1.6% from last year but down 1.4% from November.

Looking Forward

With the standard disclaimer that no one has a crystal ball, and general advice not to listen to anyone who says they do, let's take a brief look at what is coming up for Real Estate in the new year. Firstly, as we touched on, the Bank of Canada is poised to make cuts in 2024, but the question will be how much and how fast? The BoC governor Tiff Mecklem said he expects 2024 to be a transition year in his most recent speech which implies it won’t be fast or deep. But any drop in rates will likely bring some interest from buyers back to the table.

On the other side of the equation, the provincial and federal government have finally turned their monolithic gaze on the supply side of the housing problem. How they are doing this and the effectiveness of their policies are heavily debated although it is generally agreed that they are at least focusing on the correct problem now.

In the coming year, we will see the effects of the short-term rental ban (and see if any exceptions will be made), the blanket zoning changes allowing for higher density, as well as the aggressive targets for new housing and social housing starts.

Neal Estate Group Highlights

Christmas is always a busy time at The Neal Estate Group, even as helping our clients buy and sell homes slows down. Last week, with our partners at RE/MAX Generation, we were able to sponsor a night and serve a meal at Our Place Society, and this weekend on the 23rd we will host our Skate with Santa event at Pearkes Arena. Skate rentals and hot chocolate are on us so please check out our information page here if you are interested in attending. Lastly, in October The Neal Estate Group remained the #1 RE/MAX team on Vancouver Island but we also moved up to #4 in RE/MAX Western Canada.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [November 2023]

So far in November, our sales are slower than this time last year and new listings are being added to the MLS at a faster rate. We are also sitting with 632 more listings than at the end of November 2022. This is the continuation of a trend that has been ongoing for several months with buyers being sidelined by tightening affordability and general market uncertainty. We have also seen significant legislation coming down the pipeline which, unlike past government initiatives which attacked the demand side, will look to make a difference on the supply side. A province-wide short-term rental restriction will likely add some units to the pool, especially in popular tourist destinations like Victoria. A longer-term initiative is the zoning reform legislation on which we are still awaiting some details but as it reads now will turn almost any lot into a multifamily building option.

Getting into the Numbers

In October, 407 properties changed hands on the Victoria Real Estate Board MLS, a 15.2% decline compared to the 480 properties sold in October 2022 and a 17.4% decrease from September 2023. Sales of single-family homes decreased 16.1% from October 2022, with 193 homes sold. Condo sales experienced a 7.2% dip from October 2022, totaling 141 units.

As for inventory, there were 2,756 active listings for sale on the MLS at the end of the month, marking a 2.1% increase compared to the previous month of September and a substantial 25.7% rise from the 2,192 active listings for sale at the end of October 2022. This is good news for buyers who are finding more options available to them than they have had in several years.

Considering Price

While inventory is growing and that is good news for buyers, interest rates are hitting them hard on affordability keeping us pretty squarely in “balanced market” territory. Further, though more homes are staying on the market, we aren’t yet at a point where the inventory is flooded with distressed sellers who are being forced to sell due to financial hardship.

All this to say that prices haven’t taken as much of a hit as might be expected. Average sales prices for single-family homes in the core (and all of VREB) dropped a bit in October but have recovered so far in November. Condos have been hit a bit harder and are in their third month of decline. HPI Benchmark Prices for single-family homes in the core came in at $1,305,900 in October, still up year over year but down from $1,312,200 in September. Condos came in at $585,600, also still up year over year (although less) and down from $589,600 in September.

Looking Forward

In the immediate future, we will very likely see a slowdown in sales as the market transitions into winter mode. Usually, we would see inventory dip a bit as well as sellers take their homes off the market to relist in the spring. I wouldn’t be too surprised to see inventory stay closer to its current level this year with things like the short-term rental ban boosting the listing numbers.

We briefly touched on the zoning reform that is coming down the pipe. This legislation was much needed and will have positive effects on affordability and availability but it is a long-term solution, not an immediate band-aid. The positive effects will be several years out or even a decade but at least it is moving us in the right direction. Lastly, the next interest rate announcement is scheduled for December 5th after the BoC held rates firm on October 25th. While the announcement acknowledged that the higher rates are having a dampening effect on the economy, they also declared their willingness to increase rates further if inflation continues resistance.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [October 2023]

Victoria Market Overview

It appears sales volume has finally caught up with interest rate changes. I say finally, as it has been quite a delay with interest rates climbing but sales numbers, especially in year-over-year comparisons, also climbing or remaining steady. This should not be the case. In October we are trending much lower sales per day on a year-over-year comparison and remaining about equal for new listings per day.

Part of the reason for this delay is the cushion that was created by the high levels of household savings amassed over the last few years. Another factor is that jobs have remained steady and there continues to be upward pressure on wages. Lastly, and this won’t change any time soon, a significant portion of the Victoria homeowner population doesn’t hold a mortgage and therefore is not affected by rate changes.

Getting into the Numbers

While October is trending down year over year in sales, September continued the trend of the past few months. In September, the Victoria Real Estate Board (VREB) had a total of 493 properties sold, marking a 20.2% increase compared to the 410 properties sold in September 2022. This is a 9.4% decrease from the sales recorded in August 2023.

Condominium sales rose by 23% compared to the same month in the previous year, with 155 units changing hands. Sales of single-family homes experienced a more modest increase of 3.2% in comparison to September 2022, with 228 of them finding new owners.

As of the conclusion of September, VREB displayed a total of 2,699 active listings available for purchase. This marked an 8.4% increase compared to the preceding month of August and a 17.3% uptick from the 2,300 active listings reported at the conclusion of September 2022.

Considering Price

So far the market isn’t showing any signs of distressed sellers, meaning sellers aren’t yet forced to sell due to economic conditions, at least not in large numbers. Part of this, as we mentioned, is that many owners in the core don’t hold a mortgage. In areas that are more appealing to new families and first-time buyers, such as the Westshore, mortgages are impacted much more and it is showing in the number of listings.

Overall demand is still strong enough to keep some pressure on prices although we have seen slight decreases in the last few months when we look at the median sale price of single-family homes in the core for example (prices for this segment have been creeping down since August). Home Price Index prices are lagging a bit as always.

The HPI benchmark value for a single-family home in the Victoria Core stood at $1,312,200 in September, 1% up from last year but lower than the value of $1,323,900 in August. This is the first month in a while HPI prices have shown a month-over-month decrease while median sale prices for the same segment have been trending down for 3.

Condos in the core benchmark value in September 2022 was $581,500. By September 2023, this benchmark value saw a 1.4% increase, reaching $589,600, surpassing the August value of $582,000.

Looking Ahead

We likely have about a month and a half of relatively decent activity until we see the real slowdown for the winter season. This is assuming we don’t see a huge drawback of demand from buyers whose rate holds have expired, which is possible. The next rate announcement is scheduled for October 25th and there is a good chance we will see an increase. Economists are predicting one more rate increase and then a steady hold until they start coming down again towards the end of 2024. They are also predicting that fixed interest rates will stay higher longer, leaving owners renewing mortgages with a difficult choice.

The long-term stability indicators to watch are population growth, age demographics (home sales spike as demographics get older), and housing starts, meaning how many new homes are built. The lead measures for these are immigration targets, census data, and policy change regarding zoning density. Some reports show that even zoning changes on a local level can have huge effects on both housing starts and rent prices in the long term.

Neal Estate Group Highlights

The Neal Estate Group sold 1 in 29 properties in the VREB area and 1 in 20 condos in the core. We also held our 3rd annual RE/MAX Generation Thanksgiving Pie Fundraiser. Our event was a huge success and we want to thank everyone who made it out and was able to help raise money for the food bank. We look forward to seeing you again next year.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [September 2023]

Victoria Market Overview

Monthly sales numbers have been up slightly compared to last year since May and that continued into August. September is trending roughly equal in sales per day (slightly less) compared to last September as of the 11th.

The number of active listings has been steadily increasing since December 2022 but at a much slower rate since the beginning of summer. We gained a whole 71 listings from July to August and so far in September, we are trending pretty close but slightly less than September last year, at a pace that should get us more than 71 gained listings.

Anecdotally, things have seen a boost in activity roughly in line with what we would expect for a fall market. Part of the business-as-usual feel is the Bank of Canada holding the overnight rate in their recent announcement which might have kept some potential sellers from a need-to-sell position.

Looking at months of inventory, we came in at 4.6 in August which is pretty close to the seller side within the “balanced market” range.

Getting into the Numbers

544 properties changed hands in the VREB area in August, up 13.8% from the 478 sales in August last year and down 8.6% from the previous month. Single-family homes were up 9.6% (273 sales) from last year and condos were up 10.8% (164 sales) in the same comparison.

We had 2,490 active listings at the end of August, 2.9% up from July and 16.5% up from last year. As of September 11th, there are 2,543 listings on the VREB MLS system.

Considering Price

As for prices,The Home Price Index (HPI) prices have been increasing month over month since the beginning of the year, bringing the price for the average single-family in the core close to where it was in both December/January and August 2022. Median sale prices according to the MLS system tell the same story with increasing prices since January, albeit with a little more variation.

The actual number for the HPI put single-family homes in the core at $1,329,900, 0.3% down from the previous year and 0.4% up from the previous month. Condos came in at $582,000, also down 0.3% from last year, and .7% up from the previous month.

Looking Ahead

The next Bank of Canada rate announcement is scheduled for October 25th. With inflation persisting another rate hike is not out of the question although at least a few politicians are vocal about freezing the hikes. There were also hints that the federal government might alter immigration targets partly in order to deal with housing and this could have wide-ranging effects although they would likely not be felt, or implemented immediately.

In the near future, the fall market is shaping up to be relatively strong. Sales will likely remain around current levels into October and then tapper off until the end of the year. It would be nice to see inventory climb on a year-over-year basis for the rest of the year and that seems to be pretty likely.

While we are at a much higher level of inventory than we have been in recent times, we are still well below historic numbers which leaves us open to a more volatile market depending on the whims of the demand side. Until we have far more listings on the market, even a few more motivated buyers will change the relative negotiating positions of either party.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [August 2023]

Last month we talked about the second of two consecutive interest rate hikes which brought lending rates to the highest we have seen in the last 23 years. Rates are still very much a driving force and a point of intense speculation in regard to what to expect from the Real Estate Market.

We now have a month of data to see how these rate increases have affected sales and new listings. In July, sales volume was up compared to last year as were new listings. Taking into account the seasonal cycles of the market, according to the numbers, it would appear that the new rates are not deterring buyers in the short term. From what we have been seeing on the ground, there are fewer multiple-offer situations, fewer listings selling over asking price, and general downward pressure on prices overall.

As for August, as of the 14th, it looks like sales are trending about a sale a day less than in August last year. New listings are coming on at a faster clip with about a listing and a half more per day than last year. This is based on 14.4 sales per day and 33.2 new listings per day in August so far. This is good news for buyers as it gives them more options. On the other hand, these aren’t big changes and inventory is still low compared to historical averages.

Getting Into The Numbers

July 2023, 595 properties total changed hands within the Victoria Real Estate Board area, a 16.7% increase compared to the 510 properties sold in July 2022, but a 15.6% drop from the preceding month of June. The month-over-month drop is basically on par with the drop we saw from June to July in both 2021 and 2022 and is more related to seasonality than the changes in interest rates.

By property type, condos experienced an uptick, climbing by 16.3% year over year (YoY) with 200 units sold. Single-family home sales saw a rise of 15.4% YoY, with a total of 293 units sold.

On the inventory front, there were 2,419 active listings at the end of July, and there are 2,454 as of August 14th. From the beginning of July to the end of the month there was a 3.3% increase in properties for sale, also up 11.9% compared to the 2,162 listings at the end of July last year.

Considering Price

The big consideration for price is affordability. As the cost of borrowing increases, we can expect house prices to drop in proportion. At least to some extent. This is supported by the median selling prices for single-family homes in the Victoria Core, which has been creeping down slightly since May. That being said, prices haven’t been dropping nearly in line with the decreases in affordability and that is partly because buyers are still interested, and sellers aren’t in trouble yet. That could change as more mortgages come up for renewal at higher rates.

Benchmark prices according to the Home Price Index (HPI) seem to be trying to tell a different story. The Benchmark price for a single-family home in the core in July was $1,318,800, up every month since January when it bottomed out at $1,224,000. We are still down from the peak in April 2022 when it was $1,455,600. The Benchmark value for a condo in July 2022 was $600,000, which decreased 3.7% to $578,000 in July 2023, higher than June's value of $573,800.

Anecdotally, we can say that in general properties have been sitting longer on the market and that while sales prices are still showing strong, part of the reason for that is because “the numbers” are only recording the properties that are selling. The longer properties sit, the more motivated sellers are going to become to lower their prices, and when those properties that are now sitting start selling, that change in motivation will show up in the numbers.

Looking Ahead

Looking at months of inventory (MOI), we hit 4.0 in July which would typically be the very edge of a traditional balanced market. That seems accurate, but with a caveat that we mean balanced in that the buyers who are able to stay in the market are on more equal footing at the negotiating table with sellers than they were when it was a hot sellers' market. Those who are priced out on affordability or forced to sell under financial stress might not feel the market is so “balanced”.

Economists are now predicting interest rates to ease in 25-point increments towards the end of next year, a timetable which has been revised a few times already.

Neal Estate Group Highlights

The group, in the upcoming week, is looking forward to our annual brokerage golf and BBQ as well as a Kayaking day out on the water. As always we are deeply grateful for our clients who share our love for Vancouver Island and for their business, which keeps the Air Conditioning on.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [July 2023]

As of July 12th, the Bank of Canada has taken further actions to fight inflation, with a specific concern regarding the Real Estate sector, by taking the second consecutive interest rate hike of 25 basis points. This brought us up to an overnight rate of 5% which is the highest rate we have had since April 2001 almost 23 years ago.

Despite the efforts to control inflation, demand in the Real Estate sector has remained high and the supply side, including new housing starts and inventory, has been lagging. Some economists have laid the blame for slow construction on increased building costs, including borrowing costs.

So far in the month of July (as of July 17th), looking at the sales per day and listings per day we are almost exactly even with last year. A little slower on new listings per day but only marginally. This means that at least the interest rate increase in June has had little effect on the market so far.

Part of the reason for this, other than the lack of significant inventory increases and new construction, is the increase in population especially through immigration. Last year Canada took in the highest number of immigrants since 1931 which helped with labour shortages but definitely added to pressure on the demand side with more people looking for homes, both rentals and for purchase.

Getting Into The Numbers

Looking back to June, the Victoria Real Estate Board (VREB) region saw an increase in property sales, with a total of 705 properties being sold. This is an increase of 15.2% compared to the 612 properties sold in June 2022. However, there was a slight decline of 9% in sales compared to the previous month, May 2023, as is expected and typical heading from spring to summer.

Breaking down the year-over-year numbers, condo sales saw an increase of 19.8% from June 2022, totalling 242 units sold. Single-family homes also experienced an increase of 6.6% from June 2022, with a total of 322 units sold during the same period.

By the end of June 2023, there were 2,342 active listings available for sale, which is a 7% rise in comparison to the previous month of May. This is also 13.7% up from the 2,059 active listings recorded at the end of June 2022.

Considering Price

We have always known that Victoria and Vancouver Island are somewhat more insulated from market downturns than the other parts of the country due to the willingness of buyers with money to relocate here regardless of market conditions. We often see clients who are selling in large urban centers and either retiring here or simply looking to change the pace of their lives. Those clients care less about interest rates because they have lots of cash equity.

That being said, recently we have seen a bit of a run from prices with no corresponding pressure from affordability factors whatsoever. This means buyers were still somewhat optimistic and maybe were betting on a continued stall of interest rate increases. The previous fall in prices, starting about 12 months ago, corresponded heavily not to any increase in inventory but instead to a complete withdrawal of buyers for a relatively short period of time. It’s not unthinkable for recent history to repeat itself.

Both actual sale prices and list prices reported on the MLS increased from May to June in Victoria. Looking at Benchmark prices according to the Home Price Index single-family homes increased almost 1% from the previous month to hit $1,310,100, still down 7% from last year. Condos also increased month over month but are still down 9% from last year.

Looking Forward

September 6th is the next scheduled announcement from the Bank of Canada and will be the biggest factor for the near future of the Real Estate market. As we said, we haven’t seen any big immediate change from the June rate increase in the sales numbers and we won’t be able to see the effects of the July announcement for some time. Anecdotally things are slowing down a little bit around the office but it's not at all dead by any means and it feels more like normal summer activity.

Inventory has been very slowly crawling back up although still not near historically balanced market levels. As more and more homeowners come up for renewal at much higher rates we might see that pick up. At the same time on the buyer side the right time to buy, generally speaking in Victoria is when you can afford it. Rates will come down, it's just a matter of when, and at that time there will be upward pressure on prices. The only question is how many sellers will be forced to list their homes before then.

Neal Estate Group Highlights

The Neal Estate Group kept up the momentum heading into the summer selling 1 in 28 listings in the area. We also were able to participate in a local charity baseball match at Royal Athletic Park with our RE/MAX Generation family and we were Victorious against first responders (police and firefighters). Thank you to everyone who came out to support. We will also have some client events coming down the pipe so stay tuned for your invite.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [June 2023]

May 2023 finished relatively strong in both sales and inventory. New listings continued to outpace sales despite sales being very close to last May’s numbers (when the market was hot) and much higher than this April's sales volume.

It would seem the market is very much gaining momentum month over month. Typically May would be the peak of activity before we slow back down and enter into our summer market. So far in June (as of the 12th) that is holding true, but just. June sales per day are outpacing June sales per day last year easily.

Getting into the Numbers

In May 2023, there were 775 sales which, as said, is close (1.8% more) to May 2022’s sales volume. The 775 sales is also 21.7% higher than the previous month of April (April's sales were low year over year, so May might have had some deferred activity). 248 of those sales were condos, .8% down year over year. 399 sales were single-family detached homes, 8.7% up year over year. As of June 12, we have had 264 sales and 473 new listings. The new listings per day ratio for June compared to June 2022 is about 13% lower.

We had 2,189 active listings at the end of May, and 2,228 as of June 12th. Both historically low on a 10 year average, but 7.1% up from April and 23.3% up from May 2022.

Considering Price

MOI or months of inventory has dropped for the third consecutive month hitting 2.82. This puts us back into seller market territory, which seems right for the activity we have been seeing in the field. Multiple offers are still regular and any lower in MOI and we will see more delayed offers again. Price has been climbing, but has not yet reached previous peaks. There is still a fair amount of uncertainty in the market (again, relatively) so whether price continues to climb to previous highs, or if this is just a brief bounce before stagnation, or if more declines are coming in our future, is still up in the air.

HPI, home price index for single-family dwellings in the Victoria core rose marginally from April to hit $1,297,600 in May down 8.9% from May last year. Condos rose a bit more from the previous month but still only marginally and we’re down 8.1% from 12 months ago in that property type.

Looking forward

The central bank raised interest rates again by a quarter point in June, which brings us to the highest rate for lending since May 2001. This happens right as we head into what is typically a slower season in real estate. Many homeowners who are leveraged at a higher percentage, are choosing to extend their amortization period. Essentially kicking the can down the road to the end of the term of their mortgage. What this means is that every time a mortgage term comes due there will be less disposable income buying things in the economy.

We have said before that the market is determined by what people believe. Well, now we have one group or a part of the population who needs house prices to stay relatively high at the risk of severe financial hardship, and to the detriment of new market entrance. But we also have a part of the population pulling for a severe drop in the market to the benefit of those new homebuyers or potential new homebuyers. The question is whether there will be enough buyers that believe in the status quo to keep it. The dropping MOI and increasing sales the last few months indicates that there are. If there are more interest rate increases that could change.

Neal Estate Group Highlights

In May, we significantly expanded our market share, surpassing our previous achievements. The Neal Estate Group experienced an impressive year-over-year growth, more than doubling our market share. As a result, we proudly secured 4.2% share of the market (one in 25 transactions in VREB), a significant milestone in our industry.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [May 2023]

Inventory continues to take a beating into May as the market heats up. As of May 15th sales numbers are tracking just short of May 2022, when we were in an undisputed red-hot market. Even more concerning to balanced market enthusiasts, new listings are actually tracking well short of last year. Current inventory is still higher than the peak of the hot market last year but the difference is shrinking as new listings continue to fall short and buyers return to the market.

The weekend of May 6th-7th we held our first delayed offer listing in over 6 months and ended up doing two of them (two different listings on the same day) because of the frenzied interest levels we were getting on both those listings. The same week in a different transaction, one of our agents represented a buyer who was competing in a multiple-offer situation with 10 offers in play. This is all to say - the market is hot.

The question is, how much of this activity is a return to traditional seasonality principles with the spring market accounting for a large percentage of the year's activity and how much of it is the unresolved factors that had us in last year's red hot market.

Getting into the Numbers

In April, the Victoria Real Estate Board region saw the sale of 637 properties, marking a 22.7% decline compared to the 824 properties sold in April 2022. However, there was an 8% rise in sales compared to March 2023. Condominium sales were down by 21.8% from April 2022, with 205 units sold. Single-family home sales also experienced a 19.4% decrease from April 2022, with 325 homes sold.

As of the end of April, there were 2,043 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® (an increase of 3.7% from March and a 49.7% increase from April 2022). As of May 15th, there are currently 2,108 active listings. This represents a percentage change of approximately 3.2% from the end of April.

Considering Price

Months of Inventory (MOI), which is a commonly used indicator of market conditions, came in at 3.2 MOI in April. This is lower than March and brings us just a little bit closer to what would be traditionally a seller's market without crossing into that territory.

It is worth mentioning that despite the talk of it being a hot market, prices are still lower than the peak. According to the Home Price Index (HPI), just taking single-family homes in the core for example, prices peaked in June 2022 and dropped 15.6% to March 2023. Our “ hot market” has brought us up to only 13.6% from the peak. Just a note on HPI, like most data, it is delayed and we are looking at the only available numbers for HPI which is April 2023. I think it is very likely the gap from the peak will be shortened further when the next report becomes available.

Looking Forward

Last month we talked about new legislative changes and the announcement of the Homes for People plan as well as the next interest rate announcement which will take place on June 7th. Of the two we will be more closely watching the June 7th announcement for immediate effects. If the rates go up more buyers will be sidelined and we could see a much slower market as seasonal factors wear off. On the other hand, if they remain stable, the current rates are clearly baked in at this point so we will likely see business as usual.

Even with inventory rising slightly in April and so far in May we are seeing most of the increased options for buyers in price ranges outside the “entry-level” for any segment type. Part of this is that people are holding onto their homes. People who in the past might have sold their entry-level homes to move into something bigger are now opting to stay put which puts more stress on the lower price range market as these potential sellers' homes don’t end up on the market.

Interest rates and new listings will continue to be the thing to watch in our market.

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Victoria Real Estate Market Update by The Neal Estate Group [April 2023]

March sales activity was up from February, but not as much as might have been expected from what is normally our busiest month. So far in April, sales seem to be keeping a pretty good pace with March, so it's possible that some of that activity is the result of a late or prolonged spring market. Inventory in Greater Victoria has only increased marginally in the last few months and is not quite hitting the spring flood some had been hoping for to bring us back more securely into something like a balanced market. It is good news that our inventory increased at all, considering inventory across the province has fallen for two consecutive months.

Part of this stalemate of relatively stable sales and listing activity is the lack of change in interest rates, with the Bank of Canada holding rates again in their April 12 announcement. This was the second hold in a row after a very aggressive rate policy.

Getting into the Numbers

There were 590 total sales in March on the Victoria Real Estate Board multiple listing service, which was 28.3% more than in February but 29.2% less than in March 2022, when the market was much hotter. Single-family homes made up 281 of those sales, down 31.8% from last year; condos made up 197 of those sales, down 31.8% from last year. Compared to the relatively meagre 277 sales in January, there is certainly an indication of a return in demand from buyers. The good news for our clients and our Group: while the rest of VREB was down 29.2% in sales year over year, we wrote 30.7% more contracts than in the same period last year, meaning more wins for our clients.

For listings, the end of March saw 1,970 units on the MLS, which was an 8.9% increase from February; they come, however, during a time when we would expect a bigger rise due to the seasonality of real estate. The 1,970 listings in March is a pretty staggering increase from the low-lows of just 12 months previous when inventory was sitting at 1,063 units.

Offers, Prices & MOI in Victoria

Months of inventory (MOI) for March 2023 came in at 3.3, which represents the low side of a balanced market that's moving toward a seller's market. This would seem to indicate that there is some upward pressure on prices, and we've seen indications of that in some Victoria neighbourhoods. That being said, buyers are somewhat limited regarding affordability, so there is room for negotiation, with more motivated sellers lowering their prices to get a quick sale.

Regarding sellers lowering prices for multiple offers and quick sales: they are still getting multiple offers, oftentimes selling over the asking price. Offers just aren't up to the magnitude of early 2022—sellers are seeing three parties at the negotiating table instead of 14, and it's still possible for buyers to win with conditions on their offers. Provincially, average home prices have risen for two consecutive months, which is also important as the island can sometimes take a little while to catch up.

Looking Ahead

We said in a previous market update that “nothing will change if nothing changes” in reference to legislative and interest rate changes. Well, the BC government announced their new “Homes for People” plan, which promises to "speed up delivery of new homes, increase the supply of middle-income housing, fight speculation and help those who need it the most." The plan includes $4 billion over three years and a promise of another $12 billion to follow over the next 10 years. The plan will focus on eliminating restrictions and making it easier to build new construction homes while also adding thousands of social housing units. For those interested in a deeper dive, it's worth looking into the Homes for People resources.

As for interest rates, everyone is holding their breath and watching the inflation numbers in advance of the next scheduled announcement on June 7. No one—not even the economists—is claiming any certainty about inflation, though they are forecasting (with heavy disclaimers) for inflation to fall to 3% by mid-year and return to the 2% target by the end of 2024.

Neal Estate Group Highlights

The Group recently held its 24th Annual Easter Egg Hunt, which was fantastic! It featured more than 30,000 easter eggs, face painting, a colouring contest, bubble blowing, cupcake decorating, hot dogs, Sunny Bear and (of course) the Easter Bunny. On top of all that fun, we also were able to raise $4,700 for the BC Children's Hospital. We are grateful for all the volunteers who helped out and everyone else who came. We are already looking forward to the 25th!

If you want to know more about the Neal Estate Advantage, click Here for a FREE consultation or call 250-386-8181. Find new listings before they get to the MLS and ask us about featuring your home on VictoriaComingSoonListings.com

The Neal Estate Group

Your Victoria & Vancouver Island Real Estate Experts

“Let our experience be your guide

www.RonNeal.com

www.HomesOnVancouverIsland.ca

Leave a Comment

- Copy.png)

The Neal Estate Group is your #1 source for all of your Victoria BC real estate needs. Get in touch with us online or by phone at (250) 386-8181 to speak with a Victoria real estate buying or selling expert today. With decades of experience as a top selling Victoria REALTOR® and ranked in top 1% globally with over 5,000 transactions and $1 Billion SOLD, Ron Neal & The Neal Estate Group have the industry experience and market knowledge to help you make smart and informed buying or selling decisions.