Ontario Introduces Foreign Buyer Tax - Victoria Next?

Posted by Ron Neal on Sunday, April 23rd, 2017 at 2:40pm.

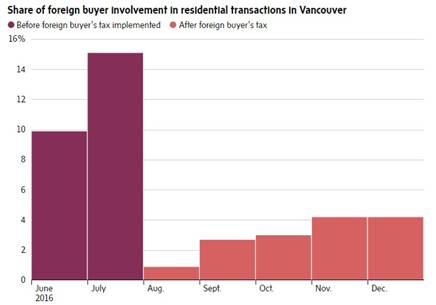

This has been talked about for months and I’ve been warning those who would listen as I expect this to impact our local Victoria market activity regardless of whether they implement the tax here in Greater Victoria. Many of our buyers until last August were arriving here after cashing out of Vancouver and over the past year we’ve had a steady stream arriving from cashing out of Toronto. We also have many coming from the USA and that will of course be impacted if they also introduce a similar tax in Greater Victoria.

What Ontario is doing:

Introducing a 15-per-cent “Non-Resident Speculation Tax” in the Greater Golden Horseshoe region

Partnering with the Canada Revenue Agency to strengthen reporting requirements and make sure taxes are paid on real-estate purchases and sales

The backstory: To crack down on real-estate speculation, Ontario is taking a page from British Columbia’s playbook. Last August, B.C. introduced a 15-per-cent tax on residential properties bought by owners who aren’t Canadian citizens or permanent residents, which sent property sales plunging almost immediately. But another side effect has been a dip in property transfer tax revenue, one of the province’s key sources of income.

Non-resident speculation tax

The centrepiece of Ontario’s new housing strategy is a 15-per-cent tax on home purchases by foreign buyers in the Greater Golden Horseshoe, from the Niagara region to Peterborough.

The measure, which resembles Vancouver’s foreign-buyers tax, will apply to most buyers who aren’t citizens or permanent residents, as well as foreign companies. It will take effect as of April 21.

About 8 per cent of home buyers in Greater Toronto are non-residents, according to the province.

The tax was generally well-received by analysts. “The Province is aiming at those effectively parking wealth in the GTA real estate market, and we have been fully in favour of such a move for some time,” wrote Robert Kavcic, senior economist at BMO. He warned the tax could modestly slow sales.

Under the tax, non-residents will need to prove that they have a legitimate reason for buying property in Ontario that goes beyond investing. The tax is not aimed at new Canadians, according to Premier Kathleen Wynne. It will be reimbursed to buyers who become permanent residents within four years of a sale, and won’t apply to international students enrolled full-time for at least two years or someone who has been legally working in Ontario for at least one year. To qualify for a rebate, the property must also be considered someone’s principal residence.

How do you think this will impact our market? Do you think they will bring the tax to Victoria?

If you are considering buying or selling now or in the near future, contact us for your FREE personal consultation.

Ron Neal & The Neal Estate Team

Victoria’s Real Estate Experts

“Go With Those Who Know”

Leave a Comment

- Copy.png)

The Neal Estate Group is your #1 source for all of your Victoria BC real estate needs. Get in touch with us online or by phone at (250) 386-8181 to speak with a Victoria real estate buying or selling expert today. With decades of experience as a top selling Victoria REALTOR® and ranked in top 1% globally with over 5,000 transactions and $1 Billion SOLD, Ron Neal & The Neal Estate Group have the industry experience and market knowledge to help you make smart and informed buying or selling decisions.