CMHC's $600 Billion Fiscal Cliff

Posted by Ron Neal on Wednesday, November 28th, 2012 at 5:19pm.

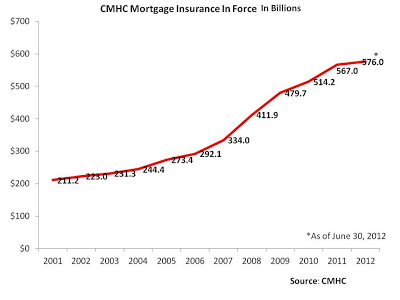

Friday, November 16, 2012 Much of the financial news we are hearing is about the US fiscal cliff. Canada has one of it's own as well. CMHC. As of June 30, 2012, at $576 billion, CMHC was creeping closer to their own $600 billion mortgage insurance in force fiscal cliff. This is what CMHC has to say about mortgage insurance in force limit CMHC Insurance Policies in Force Limit Under the National Housing Act (NHA), the total of outstanding insured amounts of all insured loans may not exceed $600 billion. CMHC's total insurance-in-force, which represents the risk exposure of the CMHC mortgage loan insurance activity, increased to approximately $576 billion as of June 30, 2012, approximately 2 per cent higher than total insurance-in-force in December 2011.

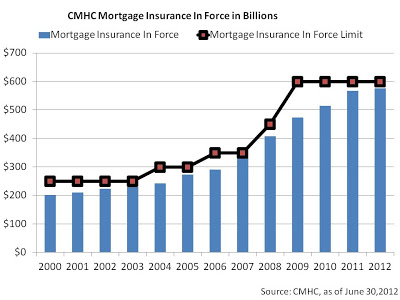

Every few years or so, CMHC would ask parliament to get the mortgage in force limit raised. But with public concerns about the housing market and the increasing amount of risk put on taxpayers, the cap was not increased. CMHC will now have to work within the $600 billion limit. Here is how mortgage insurance in force looks like with the mortgage insurance limit over the years.

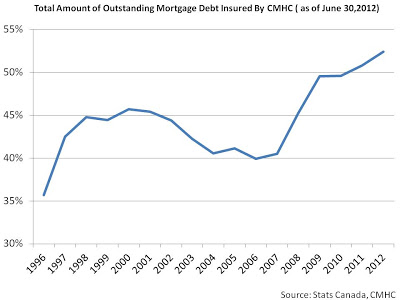

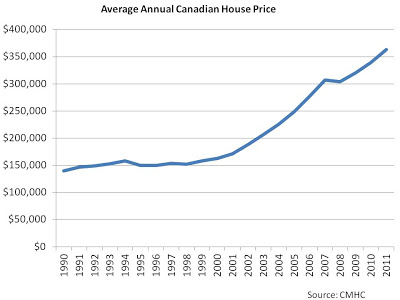

The growth of insured mortgages is not nothing short of extraordinary. And even though we know residential mortgage debt has grown through the roof, the amount of mortgages insured by CMHC has inflated even more than overall mortgage debt since 2007.

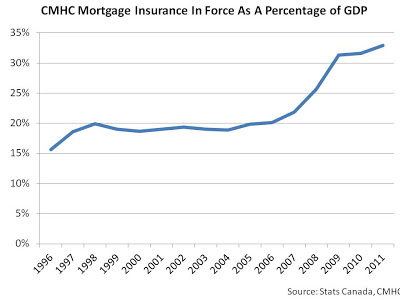

If we measure the growth in CMHC mortgage insurance in force against GDP over the years, we find this:

Something happened at the end of 2006 beginning of 2007 where mortgage insurance growth went through the roof, could not have been the loosening of mortgage rules, in that time period, could it? Pre March 2006 - CMHC: 5% down, 25 yr amortizations March 2006 - CMHC: 0% down, 30 yr amortizations (Genworth announces 35 yr amortizations) June 2006 - CMHC: 0% down, 35 yr amortizations, interest only payments allowed for 10 years Nov 2006 - CMHC: 0% down, 40 yr amortizations, interest only payments allowed for 10 years The loosening of the mortgage rules in 2006 just added fuel to the fire of ever increasing prices and sales across the country. The Canadian housing boom was in full effect in 2006 and 2007.

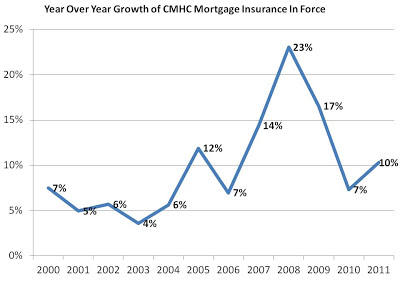

Our Canadian banks were not stupid and they knew with ever-increasing home prices along with wages that barely outpaced inflation, there was added risk to their bottom lines. So they used CMHC mortgage insurance to take that risk away from their bottom lines. Here we can see how year over year growth of mortgage insurance took off in 2007.

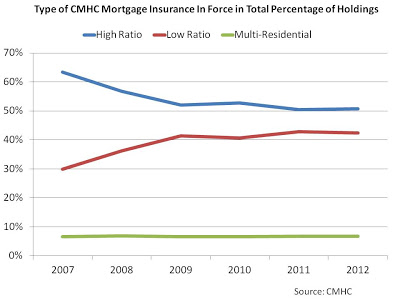

Do any of the percentages in the above graph equal wage growth, GDP growth, population growth, housing sales growth? Heck even household debt growth cannot touch most of those numbers. Make no mistake, CMHC has had one of the largest roles in the Canadian housing bubble. Remember that people don't buy homes, people with mortgages buy homes. A look at high ratio and low ratio mortgages insured by CMHC From CMHC Of the total insurance-in-force of $576 billion, approximately 43 per cent of CMHC's current insurance-in-force results from low ratio portfolio activity consisting of loans with an original loan-to-value of 80 per cent or less. Portfolio insurance provides lenders with the ability to purchase insurance on pools of previously uninsured low ratio mortgages. These insured mortgages can be securitized, providing lenders with liquidity.

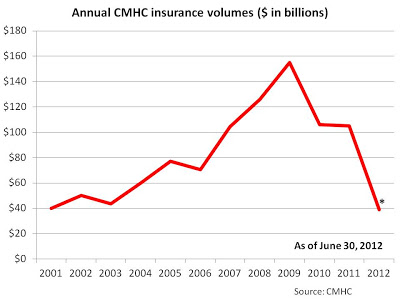

Only half of all mortgage insured by CMHC are high ratio. On the one hand this is a good thing, it means that about 25% of all outstanding mortgage debt ($1.1 trillion) is high ratio, not all of the $576 billion insured by CMHC that is widely and mistakely believed. But this does raise some questions. Wasn't CMHC put into place years ago for consumers to get easier access for mortgages? Like only for the high ratio borrowers? Why is CMHC insuring $244 billion of low ratio mortgages? So the banks can provide lower cost loans to help borrowers? Sheesh gimme a break. The banks are not in the business of "helping" borrowers. Their number one priority is to make profits and if they can do that with little to no risk, they will go down that road 10 out of 10 times. I understand there is still some risk for low ratio mortgages, but if the banks are the ones making the profits, they should have a significant amount of skin the game. But it is the taxpayers that do. If we look at the years of 2007, 2008 and 2009, we see that CMHC insured $104 billion, $126 billion and $154 billion in mortgage loans respectively. This is above and beyond what they insured years prior.

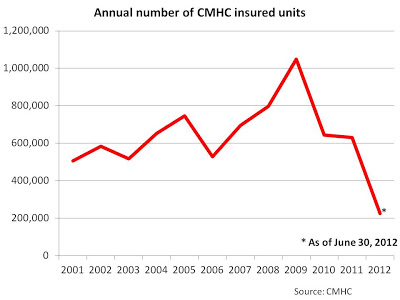

Here is the number of CMHC insured units.

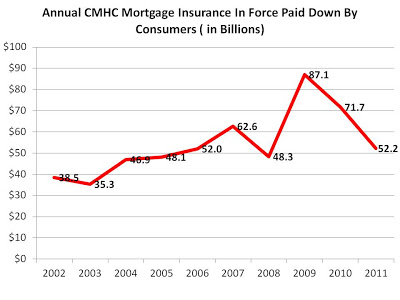

While we are told this increased liquidity in the banking sector, especially during the financial crisis ( it did) and lowered funding, it also increased profits for the banks, while offloading risk unto taxpayers. To me it seems like the banks are using CMHC to offload as much risk as possible onto taxpayers so the banks can squeeze as much profit as possible for themselves. In other words, CMHC has been used like a rented mule by the banks. And because of their bloated balance sheet, CMHC has become a major juggernaut as financial institution. And because CMHC is backed by the taxpayers, this is not exactly a good thing. How Will CMHC Stay Within The $600 Billion Limit? CMHC has reduced access to its portfolio insurance product which is expected to reduce volumes going forward to levels consistent with those experienced prior to the liquidity crisis. The insurance in force amount increases as insurance is provided to qualified homebuyers and through allocated amounts of portfolio insurance. This is off-set by insured mortgages being paid down, which serves to decrease the insurance-in-force amount. CMHC expects mortgage repayments to continue at a rate of approximately $60 to $65 billion per year. How much have consumers paid down in previous years?

Between 2007 and 2011 an average of 64 billion was paid down annually by consumers. So it is possible they can plan to stay within the limit. But CMHC's plan for 2012 was for the amount of insured mortgages to end up at $557 billion. But as of June 30,2012, that number was at $576 billion. So in the last 6 months of 2012, $21 billion would need to be chopped off to reach their goal. Will that happen? If not, CMHC will be going over their own fiscal cliff.

Leave a Comment

- Copy.png)

The Neal Estate Group is your #1 source for all of your Victoria BC real estate needs. Get in touch with us online or by phone at (250) 386-8181 to speak with a Victoria real estate buying or selling expert today. With decades of experience as a top selling Victoria REALTOR® and ranked in top 1% globally with over 5,000 transactions and $1 Billion SOLD, Ron Neal & The Neal Estate Group have the industry experience and market knowledge to help you make smart and informed buying or selling decisions.